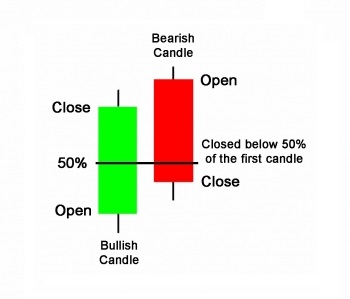

The dark cloud cover pattern is a combination of two candlesticks. Where the first day of the pattern is a long green candle at the top of the trend and the second day’s open is higher than the high of the previous. Red closes at least halfway down the previous day’s candle.

Dark Cloud Cover is a bearish reversal candlestick pattern. And it appears (useful) in the uptrend.

How to identify Dark cloud cover Pattern

- The first thing to notice is the body of the first candle is Green; the body of the second candle is Red.

- A long Green candle occurs at the top of the trend.

- The second-day candle should open higher than the trading of the prior day

- The Red candle closes more than halfway down the Green candle

Strong Trend Reversal chances with Dark cloud cover candlestick

- The longer the Green candle and the Red candle, the more chances of the reversal.

- The higher the gap up from the previous day’s close.

- The lower the black candle closes to the white candle

- High volume.

Charts with Dark cloud cover pattern

Click on images to zoom in and check DCC mentioned.

The reversal of trend with Dark cloud cover pattern higher than Hammer, Handing man, Doji, and Engulfing Candle

Disclaimer: All comapny chart are used only for learing purpose. There is no buy and sell recommandtion. All Technical analyst are learing purpose only.