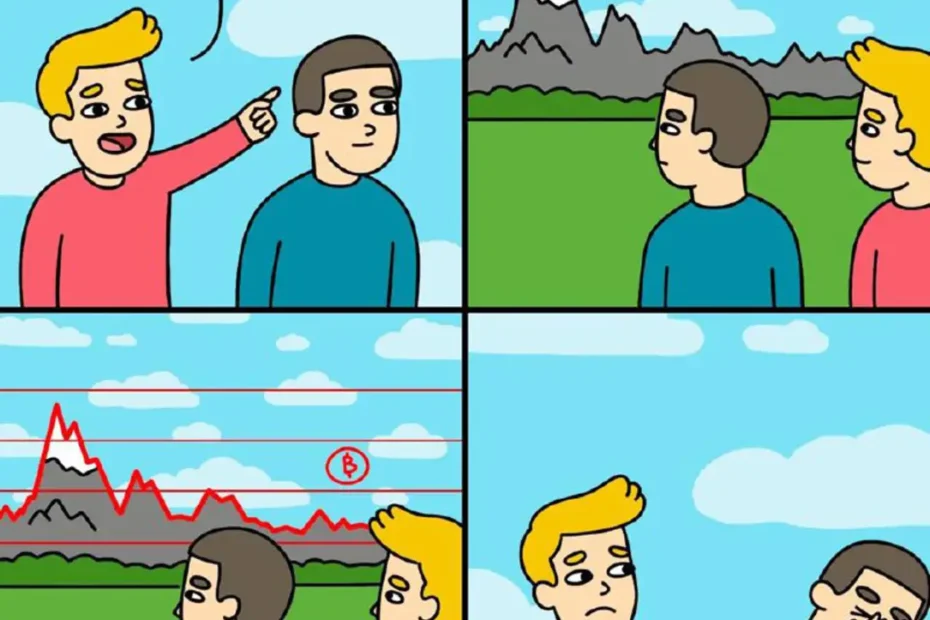

Trendline trading strategy

Trendline trading is a popular strategy used by traders to identify trends and potential trading opportunities in the market. Different types of trendlines, such as upward, downward, horizontal, and trend channels, can be used to identify key support and resistance levels and help traders make buying or selling decisions. There… Read More »Trendline trading strategy

How to Trade Trending Market

Trading in a trending market can be a profitable strategy if done correctly. Learn how to identify the trend, use technical indicators, set stop-loss and trailing stops, manage your risk, and monitor the market to trade successfully in a trending market. When it comes to trending markets, there are typically… Read More »How to Trade Trending Market

Opening Marubozu Candlestick

Opening Marubozu Candlestick’s body has no shadows extending from the open price end. It is considered a strong bullish or bearish signal and suggests that there was significant buying or selling pressure from the opening of the day and that the momentum is likely to continue in the same direction.… Read More »Opening Marubozu Candlestick

Bearish Closing Marubozu

A bearish closing Marubozu is a candlestick chart pattern indicating that bears have full control of the market, with the stock opening near its high for the day and closing near its low with no upper wick. The main character is a Red body and does not have a shadow… Read More »Bearish Closing Marubozu

Bullish Closing Marubozu

A Bullish Closing Marubozu is a candlestick pattern that signals strong bullish sentiment in the market. It is characterized by a long green or white body with no upper or lower shadow, indicating sustained buying pressure throughout the day. The main character is a green body with no shadow at… Read More »Bullish Closing Marubozu

Marubozu Candlestick Pattern

Marubozu is a popular candlestick pattern used in technical analysis, characterized by a long body and no shadow or wick. A Marubozu is a Japanese term that means “bald” or “shaved head,” It describes a candlestick with no shadow or wick. There are two types of Marubozu candlestick patterns: bullish… Read More »Marubozu Candlestick Pattern

Three stars in the South candlestick pattern

The “Three Stars in the South” is a rare bullish reversal candlestick pattern that appears at the end of a downtrend. This pattern consists of three small-bodied candles with long lower shadows that appear consecutively in a downtrend. Here are the characteristics of each candlestickCandlestick | Basic Understanding and construction:… Read More »Three stars in the South candlestick pattern

Separating Lines candlestick pattern

The Separating Lines candlestick pattern is a neutral pattern consisting of two candlesticks that have the same high or low price level. While it does not give a clear indication of trend continuation or reversal, it can be a useful signal for traders, especially when it occurs after a strong… Read More »Separating Lines candlestick pattern

Hanging man candlestick in a downtrend

A hanging man candlestick pattern is a bearish reversal pattern that occurs during an uptrend. It typically consists of a small body with a long lower shadow and little or no upper shadow. However, if you are asking about a hanging man candlestick in a downtrend, it is a bit… Read More »Hanging man candlestick in a downtrend