The shooting star candlestick pattern is one candlestick and appears at the top of an uptrend. The Japanese named this candle pattern because it looks like a shooting star falling from the sky with the tail trailing it. This pattern indicates a bearish reversal signal.

It’s a single candle pattern and it could identify by the presence of a small body with a shadow(wick) at least two times greater than the body.

You can easily identify it by the presence of a small body with a shadow at least two times greater than the body candle.

How to identify shooting star candle

- The upper shadow of the candle should be at least two times the length of the body.

- There should be no lower shadow (wick) or could be a small lower shadow.

- The current trend should be Uptrend.

Strong chances of Reversal with Shooting star candlestick

- The candle has a long upper shadow.

- A gap up from the previous day’s close.

- The day after the Shooting Star signal opens lower.

- High volume on Shooting Star day.

Real chart of shooting star pattern

Note: This pattern is also called a Bearish Pin Bar Candlestick. The Shooting Star pattern looks exactly the same as the Inverted hammer pattern, but instead of being found in a downtrend, it is found in an uptrend.

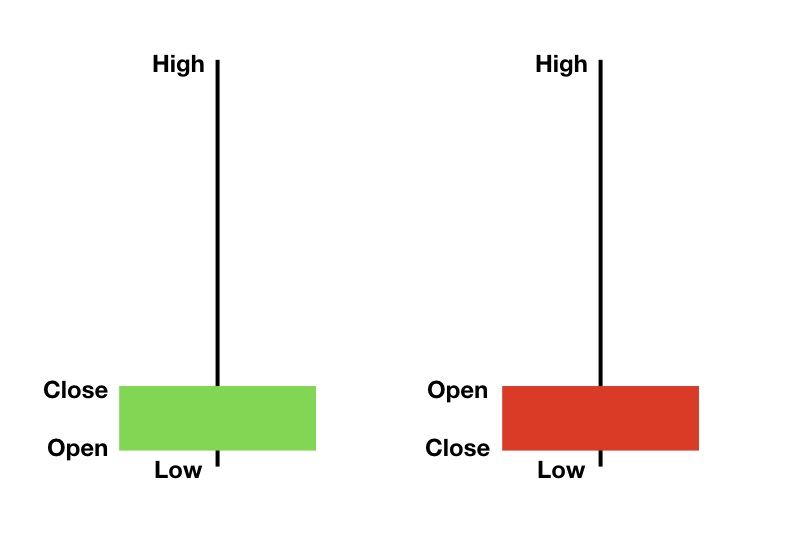

The color of the candle body is not important although a Red body should have slightly more bearish implications.

It is usually not a major reversal signal pattern as the evening star pattern.

Disclaimer: All comapny chart are used only for learing purpose. There is no buy and sell recommandtion. All Technical analyst are learing purpose only.