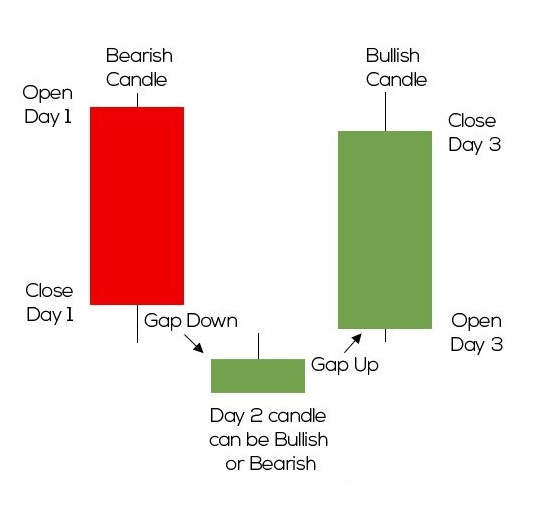

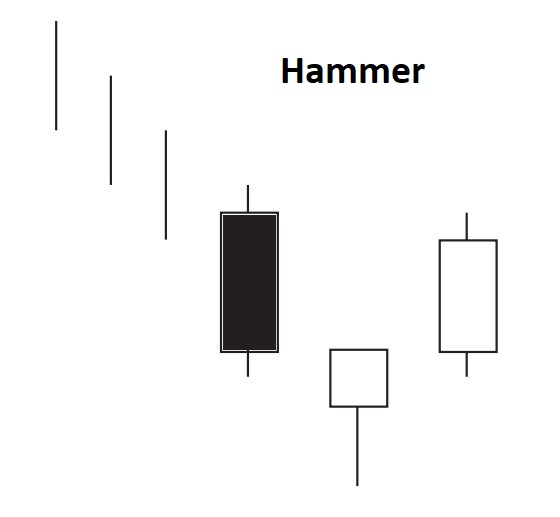

Morning star candlestick pattern formed after an obvious downtrend. It is consisting of three candlesticks that are interpreted as a bullish sign by technical analysts. Where the first candlestick is bearish, the second candle is small and the third candle is a bullish candlestick.

Identify the Morning star pattern

- The stock trend should be a downtrend.

- The body of the first candle is Red, continuing the current trend. The second candle should be small and is an indecision formation.

- That candle should green body and close at least halfway up the red candle.

Strong chances of reversal with the Morning star pattern

- The longer the Red candle and the green candle.

- 3rd candlestick has more indecision than the star day illustrates, the better probability that a reversal will occur.

- A gap down opening the second day adds to the probability that a reversal is occurring.

Chart of Morning star candlestick

Click on images to zoom in and see clear charts.

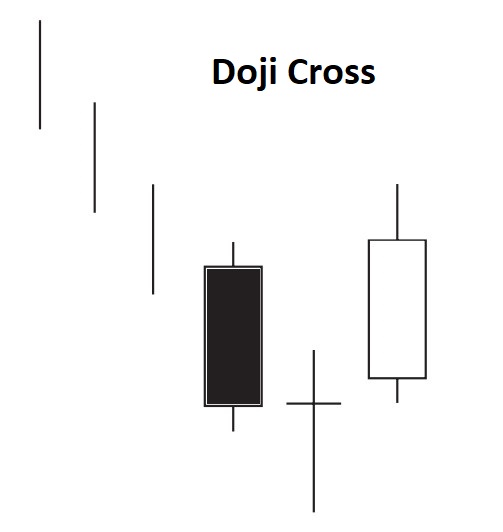

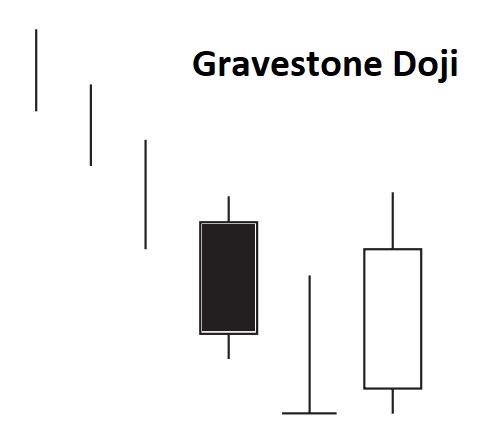

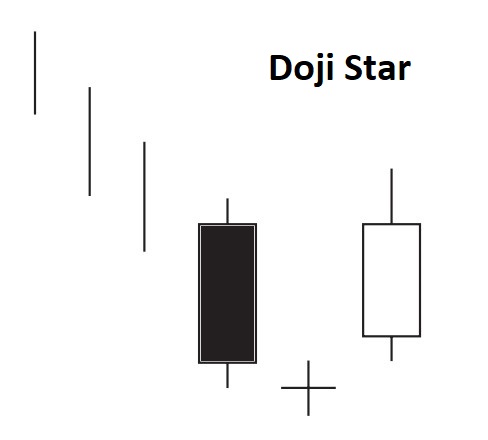

MORNING STAR DERIVATIVES

Disclaimer: All comapny chart are used only for learing purpose. There is no buy and sell recommandtion. All Technical analyst are learing purpose only.