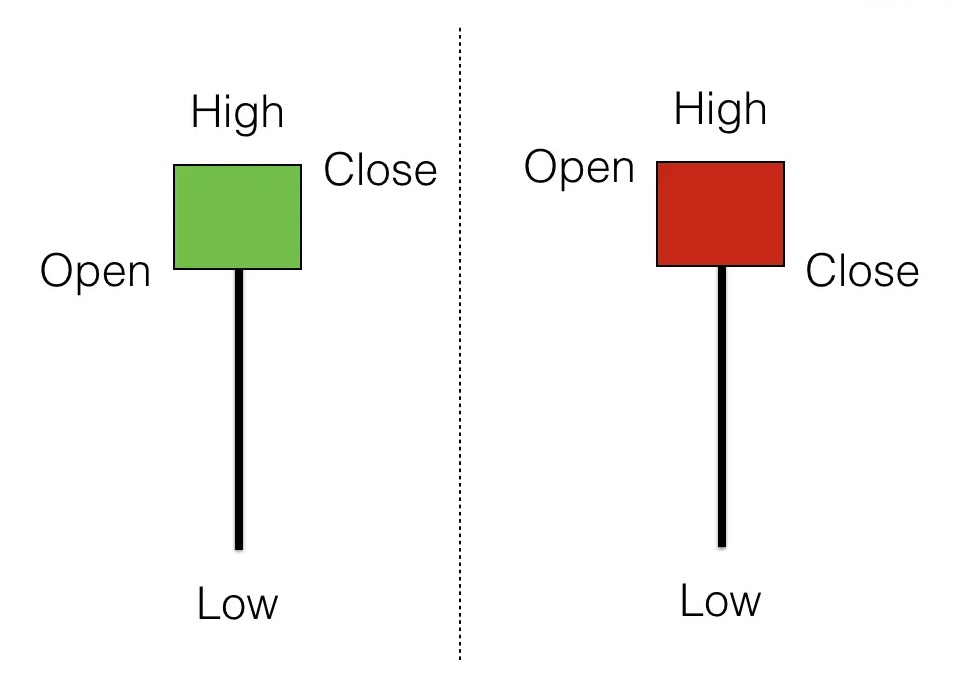

Hammer candlestick is looked a small body with a shadow at least two times greater than the body. It’s called a Hammer candle if It is found at the bottom of a downtrend, this shows possibility that the stock bottom out and will start up move.

If the color of the candle body is green then the Hammer pattern has slightly more bullish implications than the red color body candle.

How to identify Hammers candlestick

- The lower shadow should be longer at least two times the length of the body.

- Should be no upper shadow in the candle or a very small upper shadow acceptable.

- The color of the candle body is not important although a green body should have slightly more bullish implications.

Strong Reversal chances with Hammer candlestick

- The longer the lower shadow of the candle, the higher the potential of a reversal occurring.

- Large volume

- The next positive day is required the following day to confirm this signal.

Real charts with hammer candlestick Pattern

Look at the H indication for Hammer in the charts. Click on the image to zoom in.

In my experience, I seem low rate of success with Hammer candles. And it does not reverse the trend suddenly. it takes some time more than a week/

Disclaimer: All comapny chart are used only for learing purpose. There is no buy and sell recommandtion. All Technical analyst are learing purpose only.