Doji Candle is created when the opening price and closing price are the same. It indicates the bulls and the bears are in a state of indecision. It can appear at both the top and bottom of trends.

If a Doji candlestick appears at the top of a trend, Doji signals a reversal without needing confirmation.

But if Doji occurs during the downtrend requires a bullish day to confirm.

How to Identify Doji

- The open and the close are the same or nearly the same.

- The length of the shadow should not be excessively long, especially when viewed at the end of a bullish trend

Strong Reversal chances with the DOJI candle

- Candle gap away from the previous day’s close.

- More volume on the signal day increases the chances

- If appears after a long candle body

Real Chart of Doji Candle

Click on Image to view in Large.

Bullish Doji charts

Bearish Doji charts

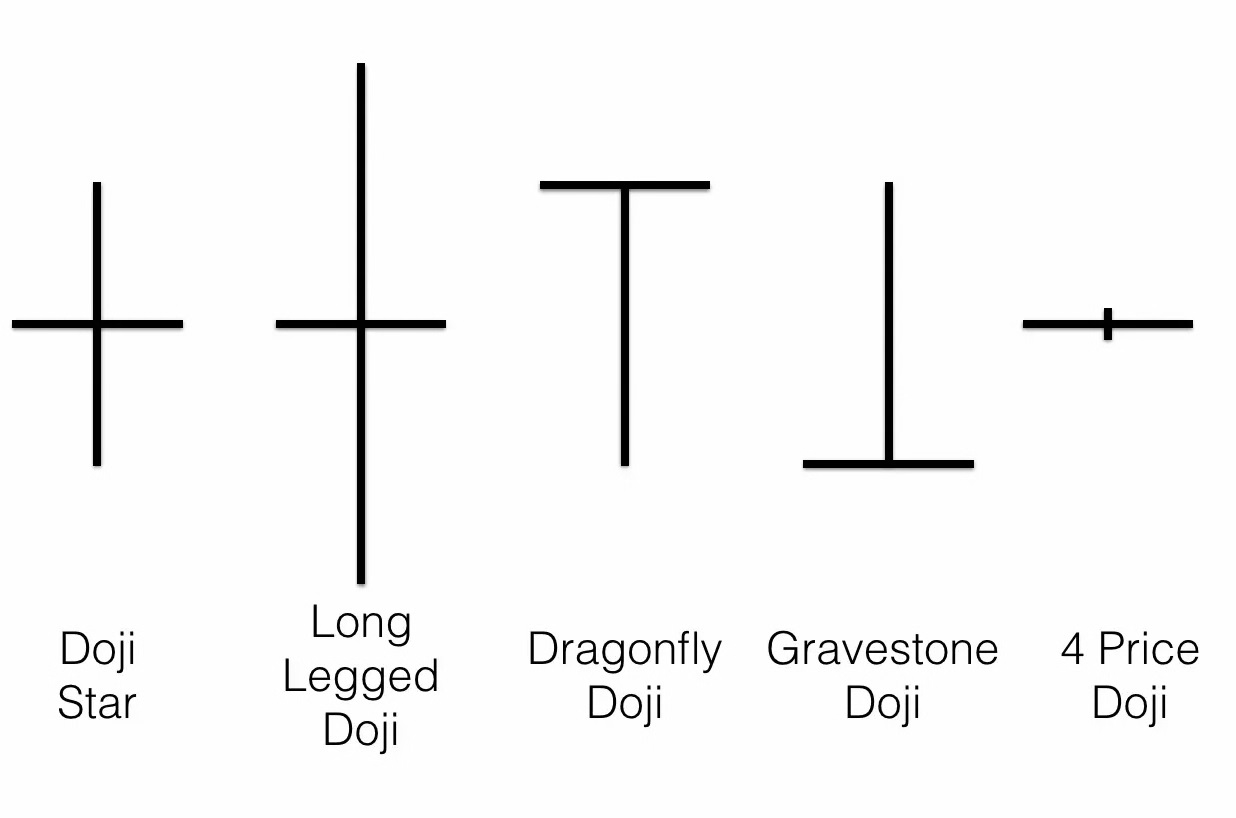

Type of Doji Candlesticks

- Long-Legged Doji

- Gravestone Doji

- Dragonfly Doji

Disclaimer: All comapny chart are used only for learing purpose. There is no buy and sell recommandtion. All Technical analyst are learing purpose only.