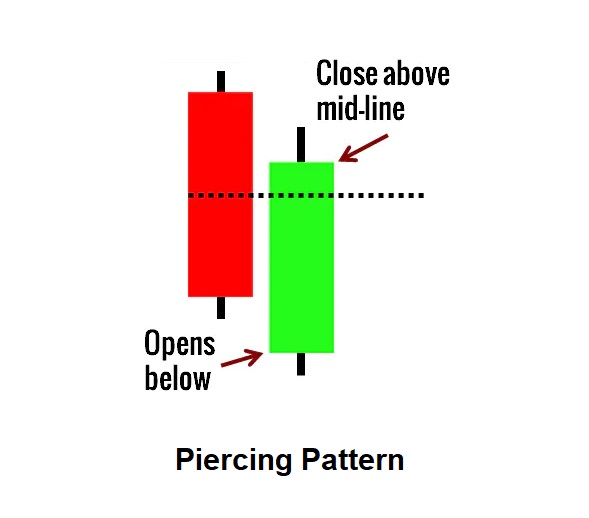

A piercing Pattern is formed by two candlesticks, typically found on a daily timeframe. The first candlestick is a long red or black candlestick, indicating a strong bearish sentiment in the market.

The second candlestick opens lower than the first candlestick’s close but then closes more than halfway up the body of the first candlestick, creating a bullish candlestick with a long lower shadow.

- The body of the first candle is red and the body of the second candle is green.

- The downtrend has been evident for a good period. A long Red candle occurs at the end of the trend.

- The second day opens lower than the trading of the prior day.

- The Green candle closes more than halfway up the Red candle.

Piercing Pattern examples

Here is a chart with this pattern.

BHEL

ICICI Bank

Note: This pattern is not given the surety of trend reversal, it should be used with other technical indicators and analysis to confirm the trend reversal.

Disclaimer: All comapny chart are used only for learing purpose. There is no buy and sell recommandtion. All Technical analyst are learing purpose only.