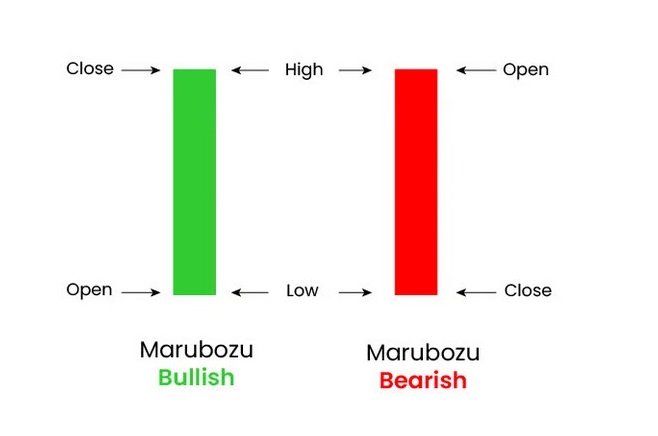

Marubozu is a popular candlestick pattern used in technical analysis, characterized by a long body and no shadow or wick. A Marubozu is a Japanese term that means “bald” or “shaved head,” It describes a candlestick with no shadow or wick.

There are two types of Marubozu candlestick patterns: bullish Marubozu and bearish Marubozu. The bullish Marubozu has a long body with no upper shadow or wick, indicating strong buying pressure and a potential uptrend. The bearish Marubozu, on the other hand, has a long body with no lower shadow or wick, indicating strong selling pressure and a potential downtrend.

A bullish Marubozu suggests a potential trend reversal or continuation to the upside, while a bearish Marubozu suggests the opposite.

Marubozu Candlestick Pattern example

Let’s see different charts for this candlestick

Bullish Marubozu

Bearish Marubozu

The success of a Marubozu pattern depends on the market conditions and other technical indicators used in combination with it. While the Marubozu pattern is considered significant because it indicates strong buying or selling pressure, it is not a foolproof predictor of market trends.

When using the Marubozu pattern, traders and analysts often combine it with other technical indicators like volume, support and resistance levels, and trend lines. This additional analysis helps to confirm or reject the potential indication of a trend reversal or continuation that the Marubozu pattern suggests.

Disclaimer: All comapny chart are used only for learing purpose. There is no buy and sell recommandtion. All Technical analyst are learing purpose only.