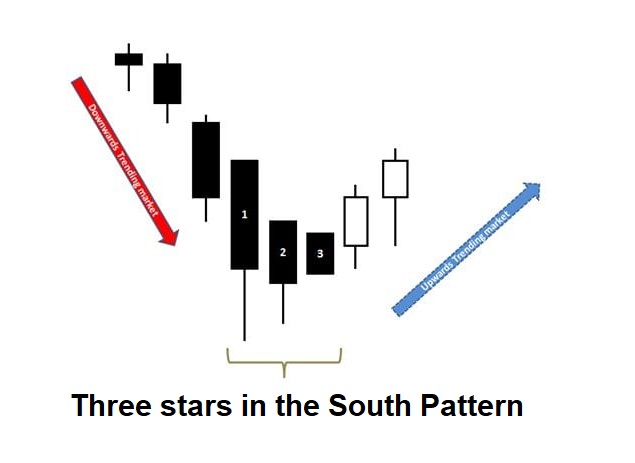

The “Three Stars in the South” is a rare bullish reversal candlestick pattern that appears at the end of a downtrend. This pattern consists of three small-bodied candles with long lower shadows that appear consecutively in a downtrend.

Here are the characteristics of each candlestickCandlestick | Basic Understanding and construction:

- The first candle is a long red candle with a long lower shadow (almost a Hammer but not quite).

- The second candle is a small-bodied candle with a long lower shadow that gaps down from the first candle.

- The third candle is a small-bodied candle with a long lower shadow that gaps down from the second candle but closes above the previous two candles. Or it could be a small Marubozu.

Three stars in the South candlestick pattern example

Here is the chart pattern for this.

The pattern suggests that sellers are losing momentum and buyers are starting to step in. The long lower shadows on each candle indicate that buyers are pushing prices up from the lows of the day, and the pattern is confirmed when the third candle closes above the previous two candles.

Disclaimer: All comapny chart are used only for learing purpose. There is no buy and sell recommandtion. All Technical analyst are learing purpose only.