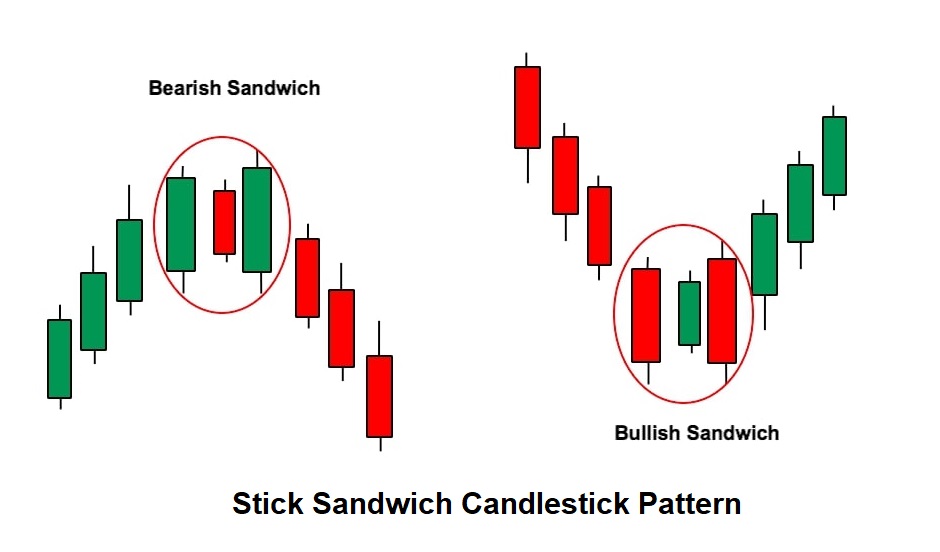

The stick Sandwich Candlestick Pattern reversal pattern consists of three candlesticks. It can occur at the end of an uptrend or a downtrend.

It has two candles with similar highs or lows, separated by a third candle that is opposite in direction. Here’s how to identify this pattern:

- The first candle is a bullish candle in an uptrend or a bearish candle in a downtrend.

- The second candle is a bearish candle with a similar high or low as the first candle.

- The third candle is a bullish candle that closes above the second candle’s close (in an uptrend) or below the second candle’s close (in a downtrend).

Stick Sandwich Candlestick Pattern example

Here are charts for this pattern.

The Stick Sandwich pattern suggests that there is indecision in the market and that a reversal could be on the horizon. This pattern doesn’t occur frequently, and it’s not always reliable, so it’s essential to use it in combination with other analysis tools.

Disclaimer: All comapny chart are used only for learing purpose. There is no buy and sell recommandtion. All Technical analyst are learing purpose only.