The Deliberation candlestick pattern is a two-candlestick pattern that can occur at the top or bottom of a trend, indicating indecision in the market.

It is formed by two long white or black candlesticks, followed by a small candlestick that gaps up or down, and then a third candlestick that closes within the range of the first candlestick.

- Uptrend: The first candlestick will be a long white candlestick, indicating bullish momentum. The second candlestick will be a small candlestick, which may indicate a potential reversal.

- Downtrend: The first candlestick will be a long black candlestick, indicating bearish momentum. The second candlestick will be a small candlestick, which may indicate a potential reversal.

However, the third candlestick closing within the range of the first candlestick suggests that the bullish trend may continue in both cases.

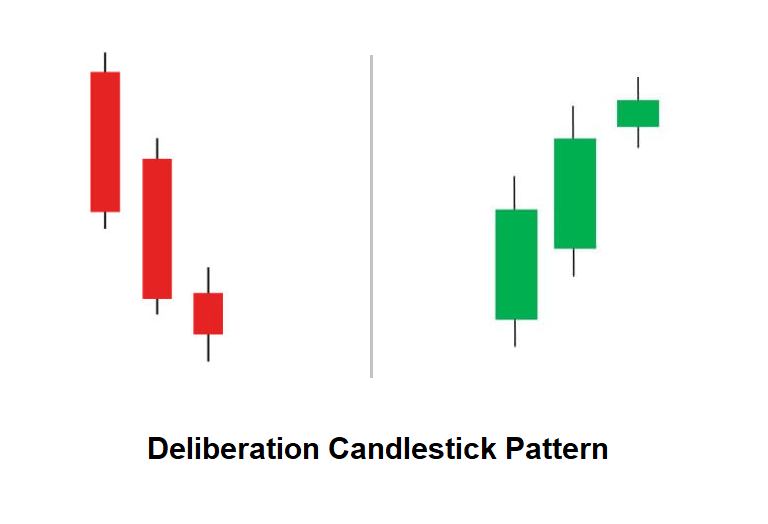

Deliberation candlestick pattern example

Here are the charts for this pattern.

Bullish Deliberation

Bearish Deliberation

Note: The Deliberation candlestick pattern is not a strong reversal signal you have to use other technical analysis tools to make trading decisions.

Disclaimer: All comapny chart are used only for learing purpose. There is no buy and sell recommandtion. All Technical analyst are learing purpose only.