Opening Marubozu Candlestick’s body has no shadows extending from the open price end. It is considered a strong bullish or bearish signal and suggests that there was significant buying or selling pressure from the opening of the day and that the momentum is likely to continue in the same direction.

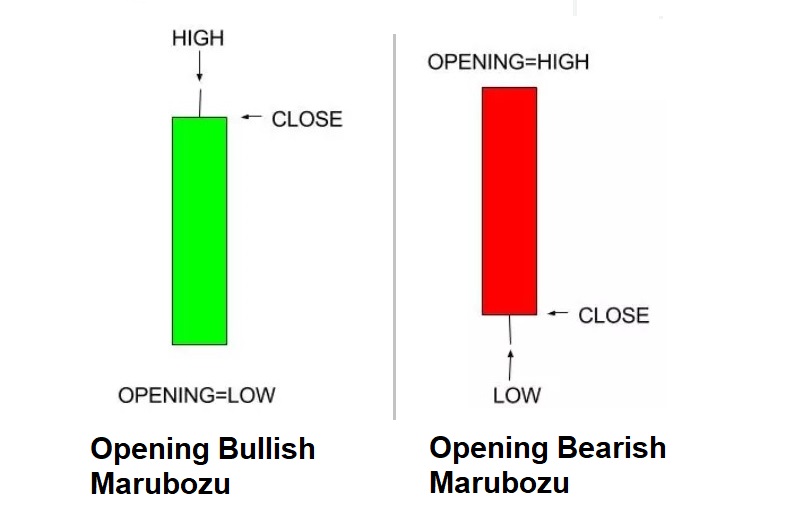

There are two types of Opening Marubozu candlestick patterns:

- Opening Bullish Marubozu: This pattern appears on a price chart with a long white or green body and no lower shadow. It suggests that the price opened at the low of the day and closed at the high of the day. This pattern is considered a strong bullish signal, indicating that there was significant buying pressure from the opening of the day and that the momentum is likely to continue in the same direction.

- Opening Bearish Marubozu: This pattern appears on a price chart with a long black or red body and no upper shadow. It suggests that the price opened at the high of the day and closed at the low of the day. This pattern is considered a strong bearish signal, indicating that there was significant selling pressure from the opening of the day and that the momentum is likely to continue in the same direction.

However, it is important to confirm the pattern with other technical indicators before making a trading decision.

Opening Marubozu Candlestick example

Let’s see the chart for these candlestick patterns

Bullish

Bearish

Disclaimer: All comapny chart are used only for learing purpose. There is no buy and sell recommandtion. All Technical analyst are learing purpose only.